Homebuyer Fund

You may be eligible to receive a contribution of up to 25% of the purchase price of your home.

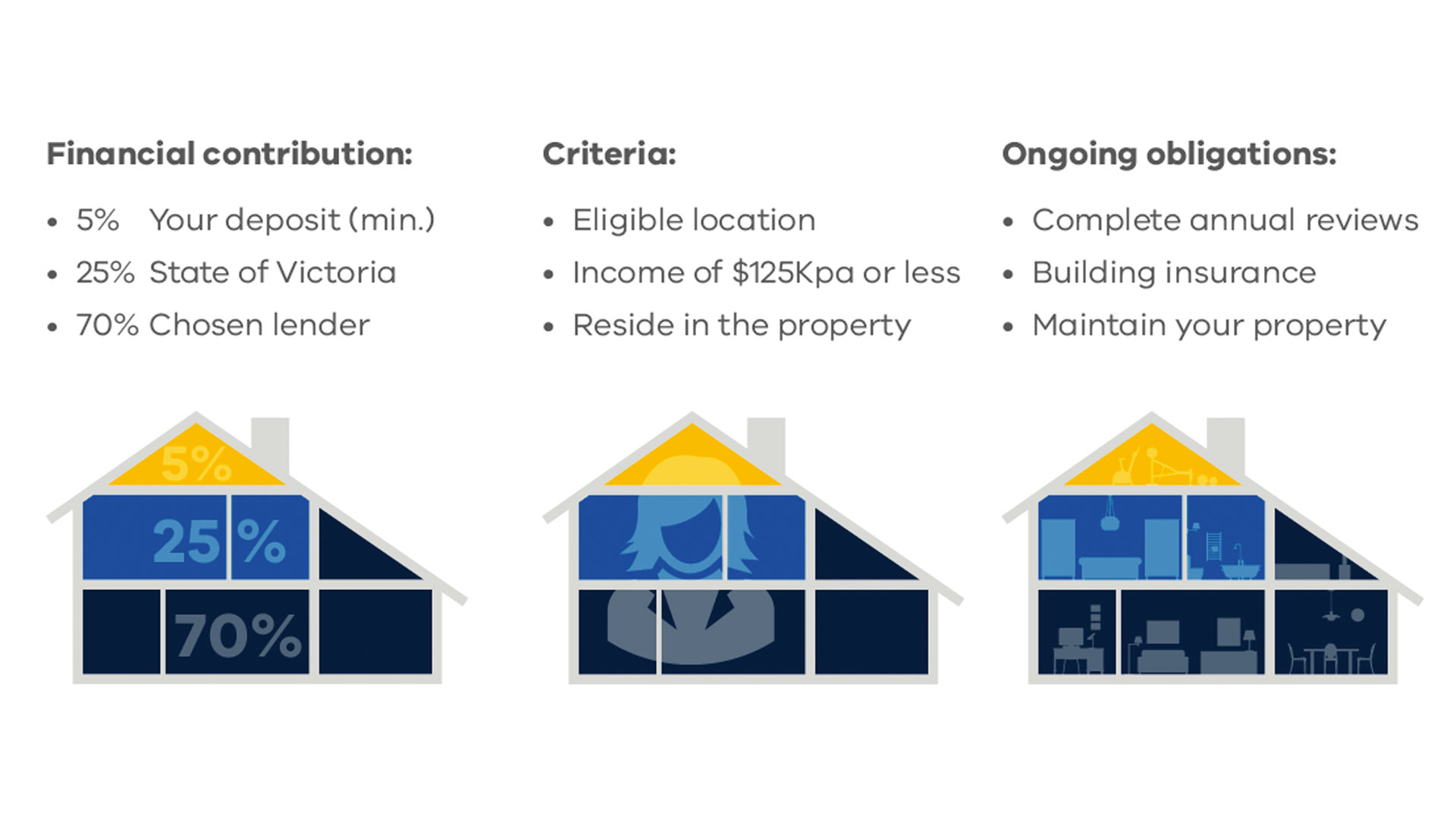

Eligible homebuyers can now receive a contribution of up to 25% towards the purchase price of their property, reducing their minimum required deposit to 5% and avoiding the need to pay Lenders Mortgage Insurance.

For eligible Aboriginal or Torres Strait Islander homebuyers, this contribution is up to 35% and the minimum required deposit is 3.5%.

The Victorian Homebuyer Fund is a shared equity scheme, meaning that the State’s financial contribution is made in exchange for a share, or proportional interest in the property.

As the value of the property changes, so too will the value of the State’s share, or interest in the property. This means the Homebuyer Fund will share in any gains in your property’s value.

Participants can repay the Homebuyer Fund’s share, or interest in their property over time. Repayments can be made by refinancing, using savings, and from proceeds when the property is sold.

Want to speak with us about the Homebuyer Fund? Contact us on (03) 7020 1549. Our business hours are 8.30am-5pm (AEST), Monday to Friday, excluding public holidays.

Who is eligible for the Homebuyer Fund?

To be eligible to participate in the Homebuyer Fund, you need to:

* Be an Australian citizen or permanent resident and be at least 18 years of age at settlement.

* Have saved the required minimum deposit (at least 5% or 3.5% depending on your circumstances) of your property price.

* Earn $125,000 or less per annum for individuals, or $200,000 or less per annum for joint applicants. This refers to your gross annual income.

* Occupy the purchased property as your principal place of residence.

* Be a natural person (that is, not an organisation, company, trust or other body or entity).

* Not purchase your property from a vendor who is a related person.

* Not own an interest in any land at the time of purchase (including as trustee of a trust or beneficiary under a trust).

* Not be acting as trustee of a trust.

* Not be a shareholder in any corporation (other than a public company) that owns any land.

Eligible participants for the Homebuyer Fund need to meet all of the above eligibility requirements and if subsequent assessments by the State and a participating lender are approved, must become registered owners of the property they buy.

Read full details on the SRO web site below.

SOURCE 11/Oct/2021: https://www.sro.vic.gov.au/homebuyer